- Information you give us. You may give us information about you by filling in forms on our or by corresponding with us by phone, email or otherwise. This includes information you provide when you register to use our website, subscribe to our service, participate in discussion boards or other social media functions on our site, and when you report a problem with our site. The information you give us may include your name, address, email address and phone number, financial and credit card information, personal description and photograph.

- Information we collect about you. With regard to each of your visits to our site we may automatically collect the following information:

- Technical information, including the IP address used to connect your computer to the Internet, your login information, browser type and version, time zone setting, browser plug-in types and versions, operating system and platform.

- Information about your visit, including the full URL clickstream to, through and from our site (including date and time); products you viewed or searched for; page response times, download errors, length of visits to certain pages, page interaction information (such as scrolling, clicks, and mouse-overs), and methods used to browse away from the page and any phone number used to call our customer service number.

- Information we receive from other sources. We may receive information about you if you use any of the other sites we operate or the other services we provide. [In this case we will have informed you when we collected that data that it may be shared internally and combined with data collected on this site.] We are also working closely with third parties (including, for example, business partners, subcontractors in technical, payment and delivery services, advertising networks, analytics providers, search information providers, credit reference agencies) and may receive information about you from them.

Cookies

Our website uses cookies to distinguish you from other users of our site. This helps us to provide you with a good experience when you browse our site and also allows us to improve our site.

Use of information

- Information you give to us. We will use this information:

- To carry out our obligations arising from any contracts entered into between you and us and to provide you with the information, products and services that you request from us.

- To provide you with information about other products and services we offer that are similar to those that you have already purchased or enquired about.

- To provide you, or permit selected third parties to provide you, with information about products or services we feel may interest you. If you are an existing customer, we will only contact you by electronic means (email or SMS) with information about products and services similar to those which were the subject of a previous sale or negotiations of a sale to you. If you are a new customer, and where we permit selected third parties to use your data, we (or they) will contact you by electronic means only if you have consented to this. If you do not want us to use your data in this way, or to pass your details on to third parties for marketing purposes, please tick the relevant box situated on the form on which we collect your data if present and relevant.

- To notify you about changes to our service.

- To ensure that content from our website is presented in the most effective manner for you and for your computer.

- Information we collect about you. We will use this information:

- To administer our site and for internal operations, including troubleshooting, data analysis, testing, research, statistical and survey purposes.

- To improve our site to ensure that content is presented in the most effective manner for you and for your computer.

- To allow you to participate in interactive features of our service, when you choose to do so.

- To keep our site safe and secure.

- To measure or understand the effectiveness of advertising we serve to you and others, and to deliver relevant advertising to you.

- To suggest and recommend to you and other users of our site about products or services that may interest you or them.

- Information we receive from other sources. We may combine this information with information you give to us and information we collect about you. We may use this information and the combined information for the purposes set out above (depending on the types of information we receive).

Disclosure of your information

We may share your information with selected third parties including:

- Business partners, suppliers and subcontractors for the performance of any contract we enter into with [them or] you.

- Analytics and search engine providers that assist us in the improvement and optimization of our site.

We may disclose your personal information to third parties:

- If we sell or buy any business or assets, we may disclose your personal data to the prospective seller or buyer of such business or assets.

- Netside or substantially all of its assets are acquired by a third party, in which case personal data held by it about its customers will be one of the transferred assets.

- If we are under a duty to disclose or share your personal data in order to comply with any legal obligation, or in order to enforce or apply our terms of use [or terms and conditions of supply and other agreements; or to protect the rights, property, or safety of Netside, our customers, or others. This includes exchanging information with other companies and organizations for the purposes of fraud protection and credit risk reduction.]

Where we store your personal data:

- The data that we collect from you may be transferred to, and stored at, a destination outside the European Economic Area (EEA). It may also be processed by staff operating outside the EEA who works for us or for one of our suppliers. Such staff may be engaged in, among other things, the fulfillment of your order, the processing of your payment details and the provision of support services. By submitting your personal data, you agree to this transfer, storing or processing. We will take all steps reasonably necessary to ensure that your data is treated securely and in accordance with this privacy policy.

- All information you provide to us is stored on our secure servers.

- Unfortunately, the transmission of information via the internet is not completely secure. Although we will do our best to protect your personal data, we cannot guarantee the security of your data transmitted to our site; any transmission is at your own risk. Once we have received your information, we will use strict procedures and security features to try to prevent unauthorized access.

Your rights

You have the right to ask us not to process your personal data for marketing purposes. We will usually inform you (before collecting your data) if we intend to use your data for such purposes or if we intend to disclose your information to any third party for such purposes. You can exercise your right to prevent such processing by checking certain boxes on the forms we use to collect your data. You can also exercise the right at any time by contacting us at [email protected].

Our website may, from time to time, contain links to and from the sites of our partner networks, advertisers and affiliates. If you follow a link to any of these sites, please note that these sites have their own privacy policies and that we do not accept any responsibility or liability for these policies. Please check these policies before you submit any personal data to these sites.

Access to information

The Act gives you the right to access information held about you. Your right of access can be exercised in accordance with the Act. Any access request may be subject to a fee of $15 to meet our costs in providing you with details of the information we hold about you.

Changes to our privacy policy

Any changes we may make to our privacy policy in the future will be posted on this page. Please check back frequently to see any updates or changes to our privacy policy.

]]>What a crypto exchange is

A crypto exchange is a trading platform where various cryptocurrencies can be sold, purchased, or exchanged. Similar to Forex, a crypto exchange brings together buyers and sellers of a currency (in this case, cryptographic), ensuring the reliability of deals. As with any exchange, it works on a trading engine, with the accuracy and speed of operations depending on the optimisation of the code. The engine verifies placed orders for asset backing, maintains records of orders in the database, and prepares data for display in a web/mobile app or trading terminal.

The first crypto exchanges were centralized and only allowed cryptocurrencies to be traded. As the market developed, the following classification emerged:

- Bitcoin exchanges or altcoin exchanges, where only cryptocurrencies are traded, mainly in pairs with bitcoin and popular altcoins.

- Cryptocurrency exchanges with fiat support, where cryptocurrencies are traded both in pairs with themselves and with fiat currencies.

- Cryptocurrency derivative exchanges, where users trade contracts on the future prices of cryptocurrencies by placing orders for a short or long position.

- Cryptocurrency exchanges with margin trading that provide leverage.

- Centralized exchanges (CEXs) of registered companies that set the rules for trading, usually operate under a licence, and are subject to regulatory authorities.

- Decentralized exchanges (DEXs) that create markets algorithmically and control them via a protocol, operate upon the basis of smart contracts and an automated market maker, and aren’t regulated by anyone.

Many crypto exchanges have characteristics of several types at a time, and large CEXs often launch a subsidiary DEX.

Popular cryptocurrency exchanges

There are over 650 cryptocurrency exchanges operating on the market, verified and listed on Coinmarketcap. Each of them tries to provide users with special conditions.

When creating a cryptocurrency exchange, keep in mind that traders pay attention to the following characteristics:

- Range of listed coins and tokens, available currency pairs

- Commission for trading, margin, deposit, withdrawal

- Methods of depositing and withdrawing funds

- Liquidity, daily trading volume

- Protection of user accounts and exchange wallets.

Spot centralized exchanges are the most popular. Amongst them, the top 3 are Binance, Coinbase, Kraken, according to the same Coinmarketcap.

Binance

Binance was launched in Hong Kong in 2017 and moved to Malta in 2018. In just a couple of years, it has grown from an ordinary exchange to an entire ecosystem where 12 projects are operating today. Binance offers 8 services for regular trading, 7 for derivative trading, 10 for earning and investing.

Specifics of Binance:

- Centralized, registered with AMF (France), FIU (Lithuania), FSA (Sweden), OAM (Italy), the Bank of Spain.

- Native coin BNB and stablecoin Binance USD (BUSD), bringing benefits to holders.

- 389 available cryptocurrencies.

- 11 fiat currencies: AUD, BRL, EUR, GBP, NGN, PLN, RON, RUB, TRY, UAH, ZAR.

- 1661 trading pairs.

- Support for derivatives and margin trading.

www.binance.com

Coinbase

The company Coinbase was established in California, USA in 2012. The initial version of its exchange was called GDAX, while the Coinbase Pro version was launched in 2018. Coinbase offers 13 services to private users, 9 services to institutional investors, 10 tools to developers.

Specifics of Coinbase:

- Centralized, registered with FinCEN (US) and FCA (UK).

- Native stablecoin USD Coin (USDC).

- 246 available cryptocurrencies.

- 3 fiat currencies: EUR, GBP, USD.

- 527 trading pairs.

- Support for derivatives.

exchange.coinbase.com

Kraken

The company Payward was established in California, USA in 2011. It launched an exchange named Kraken in 2013. Kraken periodically absorbs other exchanges and acquires services, for example: the exchanges Cavirtex, CleverCoin, Coinsetter, Crypto Facilities; the services Glidera and Cryptowatch.

Specifics of Kraken:

- Centralized, registered with FinCEN (US), FINTRAC (Canada), FCA (UK).

- 229 available cryptocurrencies.

- 7 fiat currencies: AUD, CAD, CHF, EUR, GBP, JPY, USD.

- 729 trading pairs.

- Support for derivatives and margin trading.

www.kraken.com

Revenue of popular exchanges

Cryptocurrency exchanges earn on commissions for trading and withdrawing crypto/fiat from the account. Trades are taxed at a minimum if a user pays for a fee with native exchange tokens, as well as trades in very large volumes monthly. Therefore, examples of fees in the table below start at 0%.

As a rule, exchanges don’t charge a deposit fee. The fee for withdrawing cryptocurrencies almost completely goes to pay miners or stakers of the network via which the transaction is carried out. Considering that each network has its own tariffs, we only indicated the fees for withdrawal of BTC and ETH for reference.

| Crypto exchange | Trading fee for makers, % | Trading fee for takers, % | Withdrawal fee | Trade volume per day, $ |

|---|---|---|---|---|

| Binance | 0.012–0.10 | 0.024–0.10 | Crypto: 0.0000039–0.0005 BTC; 0.000056–0.0009 ETH. Fiat: 1.8 % (Visa); 0.50–1 EUR; 0.50–1 GBP. |

5663 m |

| Coinbase | 0.00–0.40 | 0.05–0.60 | Crypto: according to network rates. Fiat: 0.15 EUR (SEPA); 1 GBP (SWIFT); 25 USD (Wire). |

693 m |

| Kraken | 0.00–0.16 | 0.10–0.26 | Crypto: 0.00001–0.0001 BTC; 0.0021–0.005 ETH. Fiat: 0.90 EUR (SEPA), 5 EUR (SWIFT); 1.95 GBP (FPS), 13 GBP (SWIFT); 4 USD (FedWire), 13 USD (SWIFT). |

520 m |

The last column, with volumes in July 2023, will help you calculate the approximate daily revenue from spot trading only. Take the average of fees for makers and takers and multiply by volume to get the average revenue of a popular exchange.

What a P2P platform is

A P2P platform is a service that allows users to sell and buy cryptocurrency directly. The buyer and seller interact with each other without the mediation of a third party. And the P2P platform only helps to select ads, pre-checks and evaluates their creators, as well as provides escrow accounts for cryptocurrencies.

CEXs usually have strict rules and requirements for users, including passing identity verification. Unlike them, P2P platforms are more loyal to users. To find the best offer in a few seconds, they only need to fill in several fields of the search form.

How P2P platforms operate

P2P platforms resemble crypto exchanges only in that they also match sellers with buyers, facilitating trading for those who need to quickly sell or buy cryptocurrencies. Otherwise, they operate very differently from both CEXs and DEXs:

- Deals are made by users themselves, rather than via execution of orders.

- The best offer is selected by the user based upon the specified cryptocurrency, amount, and payment terms.

- There are many more payment methods: bank cards and accounts, transfers via SWIFT and SEPA, electronic payment systems.

- There are no commissions for deals because users made them directly.

- Sellers’ cryptocurrencies are stored in escrow accounts, which protects both them and buyers from violating the terms of the deal.

- Most platforms have a user rating system to improve the quality and security of deals.

- The seller and the buyer can discuss deals in a chat window.

- If the parties have problems like a dispute, they can file an appeal through their personal account.

When creating a P2P platform, keep in mind that users pay attention to the following factors:

- Interface, which should be intuitive and user-friendly so that users can quickly create or find ads and make deals easily

- Security, which should include two-factor authentication, encryption, confirmation of withdrawal using a code in SMS and email

- Reputation, which should be impeccable, because today sellers and buyers carefully check crypto services due to frequent scams

- Customer support, which should instantly process appeals and solve problems.

Users additionally pay attention to available payment methods, the number of ads (liquidity), and the absence of scammers on the platform.

Do you need a P2P platform? Netside develops them from scratch and also implements a P2P service on existing trading platforms. Contact us on Telegram, and after a detailed discussion, we will get started on your project right away!

What an instant exchange service is

A crypto instant exchange service is a website without a trading engine and an order book. It itself acts as the second party in trading, that is, it sells and buys cryptocurrency. In this way, it more resembles an offline currency exchange point.

Unlike crypto exchanges, where prices depend on the balance of supply and demand, on an instant exchange service, the owner sets the exchange rates themselves. On the one hand, this is an advantage of instant exchange services because they don’t allow users to practise ‘pump’ and ‘dump’ schemes. On the other hand, this is their disadvantage because the prices on crypto exchanges are more favourable.

It’s more profitable to create an instant exchange service than a crypto exchange: development costs half as much and pricing depends on the owner, not traders. While administrators often look at market prices on exchanges, many buy and sell at significantly different exchange rates. And their customers can’t choose an acceptable selling or buying price for themselves, or specify their own, unlike orders on exchanges.

When creating an instant exchange service, keep in mind that users pay attention to the following characteristics:

- Opening hours

- Efficiency of customer support

- Variety of currency pairs with popular coins and tokens

- Slight difference with market prices

- Low commissions

- User interface convenience

- Smooth operation.

How to create a crypto exchange

There are two practical approaches: creating a cryptocurrency exchange from scratch or purchasing a ready-made software solution.

Developing a crypto exchange from scratch

A difficult but competent approach that allows you to get to know the crypto market better by coming through all stages of creating the future service, from concept design to final release. In a basic version, a crypto exchange consists of a trading engine, admin panel, database, user interface, account management centre, and web wallets.

Advantages:

- Confidence in security

- Getting a custom product

- Opportunity to refine and improve an exchange.

Disadvantages:

- Launching ultimately takes longer than installing a ready-made solution

- Turnkey crypto exchange is more expensive as a result.

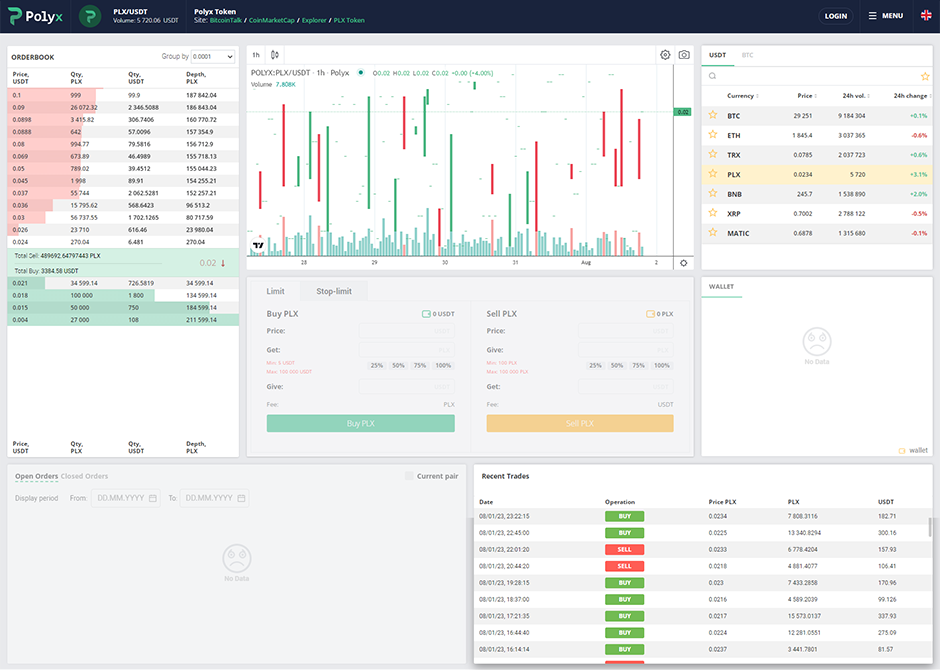

Polyx as an example of creating a crypto exchange from scratch

We were given the task: to develop a cryptocurrency exchange so that it would be an ‘all-in-one’ service. Its clients were to be not only professional traders and investors, but also ordinary users who could buy cryptocurrency just like any digital product. Therefore, we added various useful services to the basic version to expand audience reach.

Today, Polyx.net platform consists of 11 components:

- Crypto exchange.

- Instant exchange service (based on the exchange).

- Web wallet for cryptocurrencies.

- Portfolio for crypto assets.

- Referral program.

- Blog with cryptocurrency news.

- Mobile wallet (separate apps for iOS and Android).

- Native token, PLX, with staking option.

- Launchpad for crypto projects.

- P2P marketplace.

- DEX on a subdomain.

We didn’t implement them all at once, but gradually, in stages. For most customers, this is more convenient: you can control work progress, plan a budget, suggest new ideas during the development process, as well as order additional sections and functions gradually. Creating a turnkey crypto exchange took us 3 months (in 2019); the first 6 components were included. In 2021, we added components 7, 8, and 9, and in 2022, a couple more actual components.

We at Netside always start with the development of the terms of reference. Without this, it is impossible to estimate the time and cost of creating a turnkey cryptocurrency exchange. The TOR costs ~$5000 and takes 100+ working hours.

White label solution

White label is the adaptation of an already developed product to your brand. A crypto exchange powered by a ready-made engine can be a fill-in alternative or additional service that you would like to offer to your audience. Typically, the main activity of someone who purchases a white label solution is not related to cryptocurrencies, but is quite close in subject matter. In such a case, an affiliated crypto exchange would help meet the demand for related services or attract new customers.

Advantages:

- Quick setup and launch

- Low start-up costs.

Disadvantages:

- No access to the source code, no certainty that it is secure

- Difficulty of custom modification, which will cost more than the engine itself

- Constant dependence on a developer who owns the software.

Financial and legal matters

It may seem that the key thing when ordering a cryptocurrency exchange is to solve technological issues, but in practice it is different. According to our estimations, solving financial and legal matters takes more than half of the time. Let’s list what needs to be done.

Legal entity registration

You should choose a jurisdiction that is loyal to cryptocurrency services. It’s not so easy as cryptocurrencies are still not widely recognized and approved by the governments of most countries. Here are the states that welcome cryptocurrencies: Estonia, Malta, Netherlands, Switzerland, the USA.

Obtaining licences

In many countries, activities related to trading and storing cryptocurrencies require separate licensing. For example, in Estonia, it is necessary to obtain two licences: one for storing cryptocurrencies (for wallets), the other for exchanging cryptocurrencies for fiat (for exchanges or platforms).

KYC, KYT, AML compliance

Financial system participants must comply with anti-money laundering laws (AML). The 5th AML Directive, in force in the European Union since 10 January 2020, imposes strict requirements on the procedures to verify customers and their transactions.

KYC — Know Your Customer. This is a requirement by regulatory authorities to verify identities and residential addresses of users. Of course, you can still collect documents from users, carry out verification, and check data against various databases (PEP, sanction lists, etc.) yourself. But it is easier to turn to services that help implement the necessary verifications easily and inexpensively:

- Sum and Substance from the UK (sumsub.com)

- Trulioo from Canada (trulioo.com)

- Veriff from Estonia (veriff.com).

KYT — Know Your Transaction. This is a requirement by regulatory authorities to verify the cryptocurrencies coming from users and block those received from ‘dirty’ sources. This will prevent coins used in criminal activities, drug trafficking, and financing of terrorism from getting into circulation. Various services that allow you to verify transactions via API will also be of help here.

AML compliance. A crypto exchange should employ a certified AML officer who will track suspicious transactions, file SARs (Suspicious Activity Reports), and send them to financial monitoring services. This officer must have a background in finance and a certificate from a recognized world community, such as:

- International Compliance Association (int-comp.org)

- Association of Certified Anti-Money Laundering Specialists (acams.org).

Make certain you meet the requirements before moving on to opening a bank account. You are unlikely to be able to open an account without this.

Opening a bank account

This is the most difficult task when launching a turnkey crypto exchange or instant exchange service. Banks consider cryptocurrency activities to be high-risk, so with a 99% probability they will likely refuse to open an account in Europe, even if your company has obtained the necessary licences and complies with AML laws.

The only way to get a current account is to open one in an electronic money institution. The way they work is that when you transfer fiat currencies to them, they are automatically exchanged for electronic money. And when you withdraw fiat currencies from the account, this electronic money is redeemed. It’s a bit confusing, but can be used. Strict requirements are also involved there, but they can actually be fulfilled.

Here are the financial institutions that open IBANs for cryptocurrency services:

| Name (website) | Opening cost (€) | Monthly fee (€) |

|---|---|---|

| PayDo (paydo.com) | 500 | 100 |

| Vialet (vialet.eu) | 800 | 45 |

| Bankera (bankera.com) | 900 | 200 |

| Bilderlings (bilderlings.com) | 1000 | 100 |

| Cashaa (cashaa.com) | 2000 | 1000 |

| Clearjunction (clearjunction.com) | 2000 | 1000 |

How much a cryptocurrency exchange costs

Developers aren’t used to specifying the cost for an unknown amount of work. Without holding negotiations with the customer, it is difficult to make calculations because different customers have different requests. Nonetheless, everyone wants to know in advance how much it costs to create a cryptocurrency exchange.

For a preliminary estimate, companies conduct market research and provide a range of service costs so that customers can be guided when planning a budget. We did that too and found out that rates have come down somewhat this year (they just adjusted after the crypto boom). Today, development services are provided at the following rates:

| The cost of a made-to-order crypto exchange | |

| In Europe | €60,000–270,000 |

| In North America | $65,000–300,000 |

| The cost of a made-to-order P2P platform | |

| In Europe | €45,000–190,000 |

| In North America | $50,000–210,000 |

| The cost of a made-to-order instant exchange service | |

| In Europe | €35,000–140,000 |

| In North America | $40,000–155,000 |

]]>If you still have questions, ask them via the form. We will explain everything in detail and work out a strategy for developing and promoting your cryptocurrency exchange!

Businesses should also be aware of the types of cryptocurrency wallets and their differences. And if a company is going to offer its clients a proprietary wallet, we will tell why it is better to develop a custom wallet while there are plenty of ready-to-use software wallets in the market.

What a cryptocurrency wallet is and how it works

Users often think that they store cryptocurrency right in their wallet. But in blockchain technology, coins actually stay in blocks forever after they are issued or mined. And a crypto wallet only acts as a tool that is used to manage addresses on the blockchain network as well as stores public and private keys to them.

A crypto wallet is a program or application that allows a user to interact with the blockchain: check balances, view transaction history, send and receive transfers. The latter means transferring rights to the cryptocurrency from one user to another. In fact, it isn’t even transferred because it is just assigned to a certain address on the blockchain.

Basically, a crypto wallet is similar to a bank account, only it is designed for transactions with cryptocurrencies. It shows a user how many coins they have on the balance, where they are received from, and where they are sent to. If it is a multi-currency wallet, it displays exchange rates and allows users to swap coins.

Types of cryptocurrency wallets

A crypto wallet in the form of a program, application, online service, or browser extension is considered a hot wallet because it has to be always connected to the internet. Hot wallets can be:

- Custodial or non-custodial, depending on who holds keys and controls a cryptocurrency.

- Web, mobile, or desktop, depending on the platform.

A crypto wallet that doesn’t need internet connection is considered a cold wallet. It has a physical form and can be hardware or paper.

We at Netside specialise in developing crypto wallets in the form of web and mobile apps, both custodial and non-custodial. Contact us on Telegram to discuss which type works better for you.

Custodial and non-custodial crypto wallets

This is the most important difference everyone dealing with cryptocurrencies should be aware of.

As we know, all transactions on blockchain networks go between addresses that look like bizarre combinations of letters and numbers. For example, a wallet address on Ethereum may look like this: 0x763a8268712D3E015919d0097F93601B0fd4F102.

Since information about all transactions is stored on the blockchain, everyone can easily view transaction history or the balance of any address. Special services called blockchain explorers are used for that.

To send coins to someone from their address, a user needs to sign a transaction using a private key, otherwise the network will reject it. Here’s the private key to the address from the above example: 0x34229daaf8fdb3e9d3861f1af065e8a8fa7887d76e33af19e18de8e6c33cd13f.

Only someone who knows the private key can send coins from the address. And if two or more people know the key, it will be impossible to determine who performed the transaction. This is why it is critical that the private key is stored safely.

Custodial crypto wallet

This is a wallet managed by a third party, which also stores users’ private keys on its side. Many consider this wallet type insecure due to high vulnerability. But the third party can help recover access to cryptocurrencies if the user lost their password or seed phrase.

Depending on the companies that own crypto wallets, there are two types of custodial wallets:

- Exchange-based. Such a multi-currency wallet is provided by crypto exchange platforms that generate public addresses and store private keys of their users.

- Proprietary. Such a single wallet is created by private developers that store users’ keys and all the data on their own servers.

Non-custodial crypto wallet

This is a wallet that allows a user to store private keys on their device without disclosing them to any third party. This wallet type is way more reliable in terms of security. But in this case, the user is personally responsible for storing crypto keys and seed phrases. If they lose them, their cryptocurrency will be gone for good.

Crypto wallets for different platforms

Now let’s look at three types of crypto wallets that have more obvious differences: web, mobile, and desktop. Each of them has its strengths, weaknesses, and risks. In the finance technology world, the more secure the solution, the more complex and restricted it is. So choose one that balances these factors and corresponds to your goals.

Web wallets

They are popular for the same reason as any web app or SaaS solution. Here are the advantages of web wallets:

- Easy to use

- Accessible on any device

- Device specs don’t matter.

Downsides: they may be less functional or less secure than other types.

If you are going to develop a web crypto wallet, don’t forget to enrich it with key features and enhance security. Otherwise the users will leave you for other crypto wallets, no matter how hard you try to retain them.

Mobile wallets

These have become the most popular amongst blockchain wallet users worldwide. Here are the advantages of mobile wallets:

- Easy to use

- Portable

- Paper wallet import

- Compatible with smartphone hardware (camera, Bluetooth, NFC).

Downsides: they may be laggy on low-cost smartphones. Malware may be distributed under the guise of a popular wallet.

If you are going to develop a mobile crypto wallet, don’t forget to optimize it and add it to all app stores from your official account. Also mention on your website, forum threads, and social media, where people can download your wallet. This way you will prevent them from getting to fraudulent websites with malicious clones of your app.

Desktop wallets

These are the most feature-rich. Just like mobile wallets, these crypto wallet apps store private keys on the user’s device (on a PC in this case). They don’t need a constant internet connection, and this is what makes them better than online wallets. Here are the advantages of desktop wallets:

- Broad functionality

- High security

- Better reliability compared to other wallet types

- Focus on tech-savvy users.

Some may find the last point disadvantageous. While digital currencies have already emerged from a narrow circle of enthusiasts and have reached the general public, an application designed for experienced blockchain wallet users may frighten newcomers away.

If you are planning to develop a desktop wallet, try to make its interface friendlier. And don’t forget to compose a helpful manual.

Hardware and paper crypto wallets

A hardware wallet is a physical device that stores addresses and private keys in an encrypted form. It looks like USB flash drives or MP3 players and plugs into a PC. Most have a small display that shows the current balance, address, and key. These are all functions hardware wallets have, just because they aren’t connected to the internet. Combined with encryption, this feature makes them very secure.

A paper wallet is a sheet of paper with the printed address and private key that are often duplicated in the form of QR codes. At first they were created on generator websites, then this function appeared in desktop applications. The latter also generate public and private keys and allow printing them with QR codes.

Hardware wallets and paper wallets work better for those holding larger amounts of crypto assets but rarely using them. Amongst them are long-term investors, large-scale miners, and crypto companies storing their or users’ reserves in cold wallets.

Important functions of crypto wallets

Both mobile and web wallets, as well as custodial and non-custodial ones, offer the following functions:

- Showing current balance and transaction history

- Sending cryptocurrency from one address to another

- Specifying transaction fees.

On top of that, there are three useful functions that should be implemented during the wallet development process.

User authentication

Most countries have recognized cryptocurrencies as digital assets. This is why both a cryptocurrency and related personal data should be protected and stored in a safe place. Your development company must ensure high security both for the cryptocurrencies and data of users.

To prevent fraudsters from getting access to your users’ accounts, keep all user data encrypted. Also provide an option to enable two-factor or multi-factor authentication and strengthen account access recovery.

QR code scanner

QR codes give your crypto wallet a range of advantages and growth potential. They allow cryptocurrency to be sent in a contactless way, thereby surpassing the capabilities of plastic bank cards. QR code may also come in handy for crypto payments and P2P transactions.

Transaction notifications

Any finance application has such a function as transaction notifications. Your crypto wallet should also be able to notify users. Push notifications are a means of validation and security. Crypto trading platforms with exchange-based wallets use them to notify users of cryptocurrency withdrawal requests.

Which crypto wallet app to order

There’s one rule in the crypto industry: everyone is personally responsible for their coins. This is what differs digital currency from fiat money that you can deposit to a bank account and rest assured it won’t go anywhere.

Purchasing a ready-made solution, such as a white label wallet, you will have to balance security and user-friendliness. The better the one parameter, the worse the other, and vice versa. Therefore, if you are going to store large amounts, consider ordering a cryptocurrency wallet app that will match your goals and needs.

Your proprietary crypto wallet app will open unlimited opportunities for users. Our cryptocurrency wallet development company can implement both the primary functions and advanced ones, namely:

- Multicurrency support

- Buying and selling crypto using fiat currencies

- Connecting a merchant to accept payments.

Our crypto wallet development process always include the following:

- Writing terms of reference — 18+ hours.

- Business and technical analysis — 20+ hours.

- UI and UX design — 30+ hours.

- Back-end development — 50+ hours.

- Front-end development — 40+ hours.

- Testing — 20+ hours.

How much it costs to develop a crypto wallet

The cost of cryptocurrency wallet development services depends on the type you need (custodial or non-custodial), as well as on the platform for which you need to create a cryptocurrency wallet. Of course, it also depends on the expected set of functions and the technology stack used.

| Custodial wallet development | |

| Web app | Starts at 20,000 USDT |

| Mobile wallet | Starts at 30,000 USDT |

| Non-custodial wallet development | |

| Web app | Starts at 25,000 USDT |

| Mobile wallet | Starts at 35,000 USDT |

]]>Netside is ready to develop a crypto wallet offering any functions that you and your future users may need. Send us a request to find out how much the wallet app development will cost in your case.

The essence of blockchain technology

Blockchain is an innovative system for storing and transmitting information in the form of a chain of sequential blocks containing records of transactions. The blocks are included in a single database, which is automatically updated with each new transaction. This database runs simultaneously on thousands of computers—nodes—so that each of them always has up-to-date information. This achieves decentralization, where everything works without a ‘main server.’

The basic principle of blockchain is transparency of all operations. Each participant can view any transaction at any time, and no one can change or delete them. Each block of this ledger contains information about the previous block. Therefore, it is impossible to change information in an individual block ‘retroactively,’ as it will affect all previous blocks up to the first, genesis block.

At the stage of its emergence, the technology was only used for cryptocurrencies, and a little later it began to be used by shrewd banks. And today, the new system is penetrating even deeper into our lives. Platforms for blockchain development of business apps can monitor copyright compliance, product manufacturing processes and its compliance with declared standards, not to mention any financial operations.

Benefits of implementing blockchain solutions

The introduction of blockchain technology is a strategic decision that can take your business to unprecedented heights. By leveraging its capabilities, you don’t just optimize processes, but modernise them, as well as increase security and transparency. Here’s a brief list of the benefits that await you:

- Increased security. Decentralization together with cryptography provide the highest level of security, protecting your data from unauthorised access and forgery.

- Increased transparency. A distributed ledger provides transparency across the entire network, strengthening the trust of stakeholders.

- Data integrity. Immutable records ensure data integrity, making it a trusted source.

- Optimized processes. Smart contracts automate processes, reducing the need for intermediaries and speeding up transactions.

- Cost efficiency. Eliminating intermediaries, reducing errors, and automating tasks results in savings in the long run.

- Innovation opportunities. By adopting blockchain, you open doors to innovative business models and revenue streams that will set you apart in the market.

- Customer trust. Using financial technology enhances your brand’s credibility and builds customer trust.

Implementing blockchain into your business is not just an upgrade, but a transformation. Every advantage will find its way into your company, ultimately shaping a more competitive future. As an experienced team, we strive to leverage these advantages to develop unique blockchain solutions that meet our customers’ business goals.

Blockchain app development services

Blockchain development requires not only knowledge of programming languages, but also a deep understanding of the principles of decentralized apps and cryptography. The path from concept to its implementation can be very difficult. This is where professional blockchain developers come to the rescue, who can not only simplify this path, but also maximise the benefits for your company.

Netside has been developing blockchain apps for businesses for 4 years. Contact us and we will help you create your own cryptocurrency, crypto wallet, or crypto exchange!

Cryptocurrency creation

Cryptocurrencies fall into two categories: coins based on their own blockchain, and tokens that run on third-party blockchains. Stablecoins, which are backed by assets and pegged to their value, refer to tokens.

To develop a coin, we take the actual source code, make the necessary changes to it, and compile it. Typically, development consists of the following stages:

- Writing the terms of reference.

- Compiling the coin kernel and wallet for Windows and Linux.

- Deploying full nodes.

- Creating a block browser and mining pool.

- Developing web and mobile wallets.

To develop a token, we create a smart contract and deploy it in an existing blockchain. The most popular platforms for issuing token:

- Ethereum

- BNB Chain

- Polygon

- TRON.

Crypto wallet development

A cryptocurrency wallet is an application or program that makes it possible to interact with a blockchain: check balances, view transaction history, receive and send transfers. The latter refers to the transfer of rights to cryptocurrency from one user to another, because in reality it is always in the blockchain and simply changes ownership.

A crypto wallet is similar to a bank account, only designed for cryptocurrency transactions. It shows how many coins you have at your address, where they were received from, where they were sent to. Multicurrency wallets display the exchange rate of coins to other cryptocurrencies and allow you to exchange them.

We develop the main types of crypto wallets:

- Custodial and non-custodial

- Web, mobile, and desktop.

Development of cryptocurrency exchanges and P2P platforms

A cryptocurrency exchange is a trading platform where coins, tokens, and stablecoins are sold, bought, and exchanged. It brings buyers and sellers together, ensuring the reliability of deals. The crypto exchange operates on a trading engine that checks the placed orders for asset security, keeps records in an order book, and prepares data for display in a web or mobile app.

A P2P platform is a service where buyers and sellers of cryptocurrencies interact directly, without the mediation of a third party. It only matches ads, pre-checks and rates their creators, as well as provides escrow accounts. Unlike crypto exchanges, where there are strict rules and requirements, P2P platforms are more loyal to users.

We develop cryptocurrency exchanges and P2P platforms from scratch, as well as introduce additional sections and products into existing services:

- Portfolio for crypto assets

- Launchpad for crypto projects

- Native token and stablecoin

- Referral programme.

Smart contract development

Smart contracts are used for those activities where automatic fulfilment of obligations by the parties is possible without human involvement and evaluation. A smart contract independently monitors whether certain conditions specified in it have been fully fulfilled. And the protection of its code from interference is provided by blockchain technology. That is, no intruder will be able to change the lines of code — the terms of the contract concluded by the two parties.

Decentralized apps are created on the basis of smart contracts. Smart contracts together with blockchain ensure the fulfilment of obligations on cryptocurrency products, make them reliable, and provide a secure payment system for cryptocurrencies.

We develop smart contracts that are used for:

- Issuance of tokens and algorithmic stablecoins

- Oracles and prediction markets

- Staking and farming

- Decentralized exchanges and automated market makers.

DeFi project development

Decentralized finance was first referred to as analogues of traditional financial instruments that are implemented in a decentralized architecture. Now they have grown into a publicly accessible ecosystem consisting of decentralized apps on blockchains.

The goal of DeFi is to create a financial system that is open to everyone and doesn’t require trust from users, as well as to promote the principle of self-sufficiency. Conservatives consider this principle as a flaw, but it is accustomed to taking responsibility for DeFi investments.

Here are the popular types of DeFi apps we develop:

- Algorithmic stablecoins

- Decentralized exchanges

- Decentralized autonomous organizations

- Liquidity pools

- DeFi lending platforms

- DeFi insurance platforms.

Security audits

Compliance with high security standards and resistance to DDoS attacks is a cornerstone of blockchain services. There have already been hundreds of cases where attackers either permanently disabled services or stole coins worth millions of US dollars.

If you operate a blockchain service, then security is the first thing you need to take care of. We will audit your service, identify vulnerabilities, and help you protect them.

The cost of blockchain projects

Customers often ask us how much it will cost to develop a project using blockchain, and usually their entire project description fits into a couple of paragraphs. Of course, it is impossible to estimate the cost of project development based on such little information. But we can give approximate guidelines for the cost of blockchain projects:

| Creating and issuing cryptocurrency (coin/token) | Starts at $50,000 |

| Developing a crypto wallet | Starts at $25,000 |

| Developing a crypto exchange | Starts at $65,000 |

| Developing a P2P platform | Starts at $50,000 |

| Developing a smart contract | Starts at $10,000 |

The exact cost of the project can be calculated if we make detailed terms of reference. Within its framework, we would already be able to estimate the number of hours that will be required to develop a blockchain project, and to calculate the total cost by multiplying the number of hours by the rate. The average rate of blockchain developers is $50–70 per hour, but in some cases it can reach $100.

]]>The development of successful cryptocurrency projects capable of making their creators wealthy and famous involves teams of diverse specialists who work shoulder to shoulder to achieve the common goals. Let’s tell you how to create a cryptocurrency and get through the major phases you can’t blow over.

Typical crypto project components

Crypto project concept and white paper development

Just as the construction of a solid house starts with design, the cornerstone of creating a new cryptocurrency is the concept. It’s the white paper with a detailed description of your idea, which will convince the investors that the demand for your coin or token will grow. This is the most complex document as it takes extremely long to draw and work out. Working on the concept usually covers the following:

- Selecting a base coin for a fork or a smart contract concept for a token

- Forming cryptocurrency characteristics

- Formalising the legal framework of the coin

- Describing product specifics and values

- Planning the initial offering

- Outlining a roadmap, i.e. the project development plan with key milestones on the timeline.

Legal matters

The most important development phase is forming the legal concept of the coin. It will help avoid many problems with regulatory authorities, including prosecution by the SEC and initiation of a criminal case. You will need to register legal entities, draw up legal documents (including the Legal Opinion), and open bank accounts.

Technological matters

At this development phase, the entire technological framework, engine, crypto wallets, promo website, and personal account are created. Here you need to decide whether it will be a coin with its own blockchain or a token on popular blockchain platforms (Ethereum, Cardano, TRON). We have written about the key differences between these approaches below.

Token sale or initial offering (ICO, IEO)

The initial offering of a coin or token to the investors. The ICO development implies creating the investor account and large marketing costs aimed at attracting investors. This stage includes cryptocurrency promotion, advertising, and forming a community. You should run a blog on your website or social media channels. The fund generation volume depends on skilful marketing management. Conducting bounty campaigns also catalysed the coin’s evolution and popularity.

Since 2019, there has been a demand for initial exchange offerings (IEO). Generally, this event is handier as it doesn’t require creating an investor account, carrying out KYC verifications and other procedures as all of it falls within the crypto exchange’s responsibility. However, you will have to pay it for the IEO service. At the same time, exchanges set very severe requirements for candidate projects.

Getting listed on crypto exchanges, market making

Being present on 2–3 crypto exchanges where trading will be launched is one of the cornerstones of successful development of your cryptocurrency. At the very beginning, the trade volume may be poor or even zero. In this case, startups resort to market makers. By the way, Netside also provides market making services.

Cryptocurrency development costs

| Concept and white paper development | This costs $5000–8000 and takes about a month. |

| Legal matters | This costs $8000–16,000 and takes several months. It can be done in parallel with arranging technological matters. |

| Technological matters: developing the coin protocol, deploying nodes, creating wallets and a website | This costs at least $50,000. It’s possible to save ~$15,000 if you issue tokens on the Ethereum blockchain; however, this may entail some inconveniences. |

| Token sale, initial offering | Token sale costs at least $50,000. For IEO, 10–25% of the collected funds must be paid to an exchange. |

| Getting listed on crypto exchanges | The cost depends on the ranking of an exchange on Coinmarketcap:

|

Legal and financial matters

Financial regulatory authorities of states seeking to streamline the cryptocurrency sector have already developed guidelines that prescribe the classification:

- Swiss Financial Markets Authority (FINMA) — February 2018 version

- The US Securities and Exchange Commission (SEC) — April 2019 version

- The UK Financial Conduct Authority (FCA) — July 2019 version.

Despite some terminological differences, those authorities divide cryptocurrencies into three types:

- Payment tokens (FINMA) / coins (SEC) / exchange tokens (FCA). These are cryptocurrencies with their own blockchain technology, such as Bitcoin, Dogecoin, Ethereum, Litecoin, and other altcoins. Some countries have already recognized them as a means of payment, others only consider them as a digital asset. However, nowhere are coins classified as securities and don’t need to be registered for issuance. This type is, after all, designed for payments, not for receiving yield or rights by stakeholders.

- Utility tokens (FINMA, SEC, FCA unanimous). They give access to a decentralized app or service, usually only within a project that issued them. Resemble a virtual currency used in games or on social media. The only difference is that the prices of such tokens are determined not by the issuer but by supply and demand in the market. Although the issuance of utility tokens is not subject to any legal difficulties, one should always be ready to prove to a regulator the applicability of such tokens in an operating service; otherwise, they will be recognized as investment assets.

- Asset tokens (FINMA) / security tokens (SEC, FCA). Their holder can claim a share of the company’s profit or participation in its management. This type of tokens has characteristics of securities, and in most countries the unregistered issue and sale of securities or their analogues is considered a financial crime. Registering the issue and initial offering of security tokens is a long and effort-consuming process.

The UK FCA has an additional condition regarding stablecoins: if they are backed by fiat assets or a basket of crypto assets, they may be recognized as electronic money. That said, they will be placed alongside fiat currencies of electronic payment systems such as PayPal and Worldpay. This causes even more confusion, especially because stablecoins are not actually coins (despite the ‘-coins’ in the word) but utility tokens.

Beware of the SEC

A proper concept and knowledge of the specifics of different jurisdictions are advantages that may help avoid a ton of problems. Issuing tokens in the United States or for the US market, be ready to become a target for the Securities and Exchange Commission. Below is the list of companies and their cryptocurrencies that have been involved in SEC-initiated litigation for H1 2023:

| Date | Company (cryptocurrency ticker) | Funds raised ($) | Status |

|---|---|---|---|

| 18 May 2023 | Hydrogen Technology (HYDRO) | 2.2 m | Prohibition of cooperation with investment consultants, brokers, dealers, advisors, agents |

| 28 April 2023 | Up, Global SEZC, Coinme (UP) | 3.65 m | Civil money penalties of $3.52 m and $250 000 |

| 24 February 2023 | ShipChain (SHIP) | 27.6 m | Civil money penalty of $2.05 m |

| 24 February 2023 | Blockchain Credit Partners, DeFi Money Market (mTokens и DMG) | 31.6 m | Disgorgement, civil penalty, and prejudgment interest in the amount of $13.4 m |

| 9 February 2023 | BitClave PTE (CAT) | 25.5 m | Disgorgement, civil penalty, and prejudgment interest in the amount of $29.3 m |

| 19 January 2023 | Nexo Capital (EIP) | 2.7 bn | Civil money penalty of $22.5 m |

| 13 January 2023 | Unikrn (UKG) | 31 m | Civil money penalty of $6.1 m |

Cryptocurrency development technology

Unlike regulatory authorities, developers only divide cryptocurrencies into coins and tokens, depending on the availability of a blockchain.

Coins (blockchain projects)

A coin is a cryptocurrency created from scratch and based on the dedicated blockchain, or using a fork of an existing coin, e.g. Bitcoin or Ethereum. Also, there is the term ‘altcoin’ (alternative coin) which means any cryptocurrency besides Bitcoin that had been the only blockchain-powered cryptocurrency until 2011.

Top 5 highest-capitalization coins (July 2023)

| Rank | Name (ticker) | Capitalization ($) | Market price ($) |

|---|---|---|---|

| 1 | Bitcoin (BTC) | 580.4 bn | 29,865.56 |

| 2 | Ethereum (ETH) | 227.8 bn | 1895.69 |

| 3 | XRP (XRP) | 41.6 bn | 0.7919 |

| 4 | Binance Coin (BNB) | 37.5 bn | 243.69 |

| 5 | Cardano (ADA) | 11.1 bn | 0.3158 |

In addition to a blockchain, such crypto projects have a network of full nodes to support the protocol running, a tech team, and a community of users.

Netside’s experienced developers have already crafted 11 coins of different complexity and are now working on two new coins. To create a cryptocurrency, we take a relevant source code, make the necessary changes, and compile it. As a rule, cryptocurrency development process consists of 5 stages:

- Terms of reference for the development of a system.

- Compiling the coin core and wallet for Windows/Linux.

- Deploying two primary nodes.

- Creating a block explorer and mining pool.

- Compiling mobile wallets for iOS and Android platforms.

Tokens (utility and security)

A token doesn’t have its own blockchain and supporting nodes but uses a third-party coin’s blockchain. Most often, Ethereum’s blockchain is chosen to create tokens, though this function is provided in various blockchain projects, e.g. BNB Smart Chain, TRON. Despite the fact that tokens are used as an internal currency or a means of access to a decentralized app/service, first investors try to purchase them for further reselling on crypto exchanges.

Top 5 highest-capitalization tokens (July 2023)

| Rank | Name (ticker) | Blockchain development platform | Capitalization ($) | Market price ($) |

|---|---|---|---|---|

| 1 | Tether (USDT) | Omni / Ethereum / Algorand / TRON / BNB Smart Chain | 83.8 bn | 1.00 |

| 2 | USD Coin (USDC) | Ethereum / Solana / TRON / BNB Smart Chain / Fantom | 26.9 bn | 1,00 |

| 3 | Wrapped Bitcoin (WBTC) | Ethereum / Near / Fantom / Polygon | 4.8 bn | 29,865.56 |

| 4 | Dai (DAI) | Ethereum / Polygon / BNB Smart Chain / Fantom / Gnosis | 4.6 bn | 0.9995 |

| 5 | Shiba Inu (SHIB) | Ethereum / BNB Smart Chain / Solana / Terra | 4.6 bn | 0.00000778 |

To create a token, we need to craft a smart contract and embed it in a blockchain. Take into account the peculiarity of ERC tokens on Ethereum: any operation there, whether issuing or transferring tokens, consumes gas (network fee) which costs a certain amount of ether. Thus, to make a transaction, the sender must have not only ERC tokens in their wallet but also ETH coins. And this is not always that convenient.

The development of a smart contract takes from one week and costs $1000–5000. The integration with web services and web wallet, as well as further token offering, are being worked out separately.

Our developers have 4 years of experience in both programming smart contracts for tokens and creating blockchain-powered coins. Contact us on Telegram to learn more about turnkey cryptocurrency development.

Cryptocurrency website

You will need to build a website that will clearly convey the value of your project to potential investors. What most projects stay with is a one-page structure which comes in very handy for awareness purposes. The main website and white paper language is English, but there are also often versions localised into 3–5 common languages. The website usually contains the following:

- General project info, white paper.

- Development team (5–7 key members). The more professional the team looks, the more funds you will be able to raise.

- Links to social channels or profiles (Twitter, Telegram, Facebook, Medium, LinkedIn). Most success factors depend on skilful community management.

- Section of investor personal account.

- Links to download a desktop, mobile, or web wallet; it is better to have all types at once.

- A list of exchanges and open markets where people can purchase your new cryptocurrency.

What an ICO is

An initial coin offering is an event during which a token or coin is presented to investors. Simply put, it is the issuance of a specific number of tokens or coins and an attempt to convince future investors to buy them for a more liquid cryptocurrency (e.g. BTC or ETH) at the price set by the creator. Quite often, ERC tokens are used in this context, as it is easy to program and deploy smart contracts in Ethereum.

Getting listed on exchanges

Once you have issued a cryptocurrency and sold some through your website, you may wonder where people will trade the new coin and how to expand the audience. To get new investors and traders interested and involved in active trading, you need your crypto to be listed. Before listing, the exchange will ask you to get through preparatory procedures:

- Your project must have a live community with communication channels (e.g. Facebook, Telegram, Twitter, etc.).

- You have to pay for the listing service, which costs from $1000 for little-known exchanges to $500,000 for popular ones. Moreover, popular exchanges want to add coins of only those projects that prove their worthiness.

- You have to provide the experienced team that will integrate your project with the exchange.

Initial Exchange Offering (IEO)

Since early 2019, the initial exchange offering has begun to conquer the crypto market. At the same time, ICO and traditional listing haven’t gone anywhere, an alternative solution for cryptocurrency developers has just appeared. IEO is considered a hybrid of the ICO and listing, or a token sale held immediately on the crypto exchange. Here you only need to cooperate with a proper crypto exchange. Crypto project developers find many advantages in this model:

- The website doesn’t need to have investor accounts

- An exchange has a base of loyal users

- Traders and investors rush to buy a new cryptocurrency verified by the exchange

- An exchange acts as a partner in promotion, announcing the project on its channels

- The market entry and sales of developed cryptocurrency are accelerated.

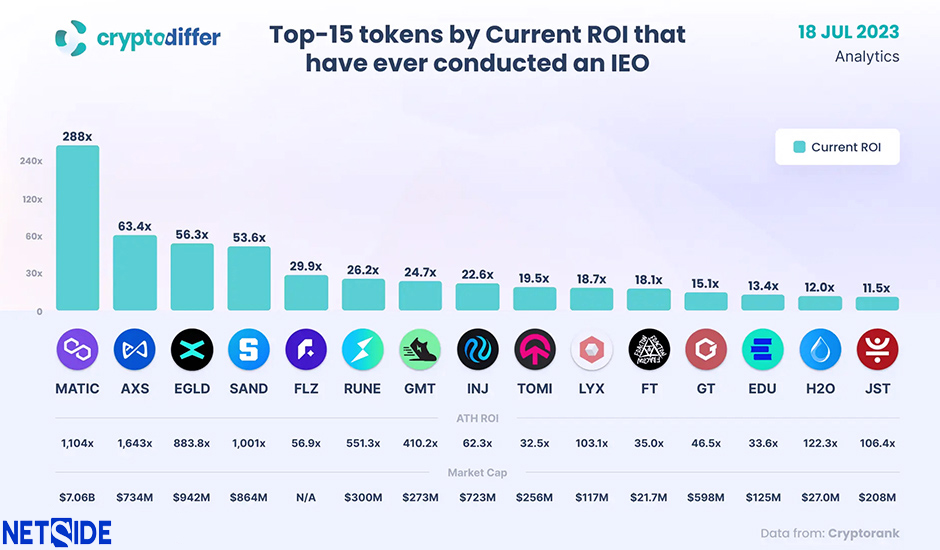

For example, here are the top 15 most successful tokens that have ever held an IEO (as of July 2023):

Besides the ICO and IEO, there are other innovative solutions to facilitate cryptocurrency offerings: Security Token Offering (STO), Initial Airdrop Offering (IAO), Initial Fork Offering (IFO), Initial Miner Offering (IMO).

]]>Want to get into all the nuances? Submit a request and we will explain everything in detail. Then together we will work out a strategy for developing a cryptocurrency from scratch and offering it on exchanges!

The first thing that comes to mind is something from law, some kind of smart contracts, which are monitored by an algorithm and probably can’t be violated. The second thing you might think of is the future of transactions: soon they will only be concluded through smart contracts. Let’s see if that is really the case.

What a smart contract is

A smart contract is a computer algorithm designed to help conclude an agreement, monitor fulfilment of a contract, and execute the obligations. Created in code, it is only executed on a blockchain, a distributed ledger controlled by a decentralized network of peer nodes.

As you might have guessed, this process has nothing to do with conventional deals. You can’t use a smart contract to buy a car or secure the supply of a carload of wheat. But you are free to exchange one token for another without any intermediaries, or deposit a token at interest with a crypto bank.

In the real world, contracts are concluded on paper or electronically, with the use of the digital signature. Contract fulfilment is monitored by the state, and disputes are resolved in court. There are some mentions on the web of people selling an apartment or another asset using a smart contract. But such information is nothing but deception.

Like offline, where contracts are regulated by certain countries and jurisdictions, a smart contract is only valid on the network where it is written and deployed.

It’s easier to grasp this with the example of a vending machine. One user puts stamps into the machine, the other puts seashells. The machine uses the exchange rate of 2 stamps per seashell. Both users trust the machine since its source code is public and everyone can read it.

How smart contracts emerged

The idea and the term ‘smart contract’ were coined by Nick Szabo in 1994. He described a smart contract as a cryptographic protocol that conducts and monitors contracts using a set of algorithms.

Smart contracts saw broad application in practice with the emergence of Ethereum. In 2013, the future project founder Vitalik Buterin realised that Bitcoin’s protocol was unusable for smart contracts because it had been designed for other purposes. So he decided to create a different protocol from scratch, which could be more relevant to the task.

Smart contracts help close deals and perform transactions according to pre-established rules, without any intermediaries. Blockchain makes such transactions transparent, traceable, and irreversible.

Where smart contracts are used

Applications based on smart contracts deployed on blockchain networks are called dApps (short for decentralized apps). Blockchain-based smart contracts enforce obligations on crypto projects, make them more secure, and provide a safe payment system for cryptocurrencies. Oracles play a key role in creation of next-gen smart contracts that provide fintech products and monetary instruments (e.g. market data-driven ones).

- Token issue. Perhaps the most popular use case. Hundreds of examples available in the public domain is what makes issuing tokens easy and accessible to everyone.

- Decentralized exchanges. DEXs are blockchain-based exchanges that allow trading tokens without the need to store them with centralized companies. Among the shining examples are Uniswap, PancakeSwap, SushiSwap, Polyx DEX. The most common type of DEXs is automated market makers. They are on-chain liquidity pools that exchange tokens by a specific formula rather than using the order book. They help traders access liquidity, and liquidity providers get passive income.

- Staking. Staking is a process of providing cryptocurrency as a stake in a contract. Protocols use it to ensure efficient tokenomics. With such a method, it becomes apparent where, how, and in which proportion the staking rewards should be distributed. They can also be slashed (automatically withdrawn) in some cases.

- Farming. This innovation emerged in the DeFi ecosystem and is used there to retain liquidity and distribute governance tokens evenly between users. Most DeFi projects offering farming reward liquidity providers with native tokens that fund protocol development.

- Algorithmic stablecoins. What makes them similar to centralized and decentralized stablecoins is that they are also backed by fiat money, cryptocurrency, or any other asset. But here is the difference. Algorithmic stablecoins maintain the equivalent of pegging using automated rewards and fines. If the price falls below the pegging level, excess tokens are burned; if the price gets higher than the pegging level, extra tokens are issued.

How to create a smart contract

Let’s examine how smart contracts are created with the example of Ethereum, the most common blockchain platform.

First, we need to work out the smart contract’s logic and write the source code. Developers use Solidity, a language that is somehow similar to JavaScript. The code can be written in any integrated development environment, but Remix Online IDE is the most widespread one. It allows designing a smart contract, compiling it, and placing it on the network.

After compilation is complete, we need to deploy the code on the network. For that, we create a special transaction, and the deploying address pays a fee to the network (the fee currency is ETH in our case). The more complex the smart contract, the higher the fee.

If all goes well, the deployment transaction will be executed in one of the blocks and the smart contract will end up on the blockchain with a unique address. After that, it will be able to receive commands.

How much it costs to develop a smart contract

The price of a smart contract depends on its complexity. For example, creating a simple smart contract for issuing tokens costs 1000–5000 USD, while development of sophisticated dApps starts from 10,000 USD and may cost over 100,000 USD.

We at Netside have been doing blockchain development for 4 years. For this time, we have designed around a hundred smart contracts of different complexity. Contact us on Telegram to discuss how advanced a contract your crypto project needs.

What a smart contract audit is

A security audit is an independent examination of a smart contract’s code that projects usually publish on GitHub. Audits are a must for DeFi projects and dApps whose numerous users transact millions of dollars. Usually, an audit consists of the following stages:

- Auditors conduct an initial review of contracts.

- Auditors submit the review results to the project developers for further action.

- Project developers make changes and fix the errors found.

- Auditors draw up a final report considering the changes made and remaining errors.

Auditing is a common process for large crypto projects. Most investors take into account the audit results when studying new DeFi projects. And they have more confidence in reports compiled by reputable audit firms.

Why a crypto project may need an audit

Smart contracts help transact or block gigantic amounts of cryptocurrencies. And this can be a big prey for hackers. Even tiny code errors may lead to a project losing millions of user funds. For example, a hacking of The DAO resulted in the theft of $50 million worth of ETH and Ethereum’s hard forking.

A project team needs to make sure the code is secure, since transactions on the blockchain can’t be reversed. The specificity of the technology won’t allow their cryptocurrency to be recovered, nor solve problems after a hack. This is why it is critical to find all vulnerabilities beforehand.

Purposes of smart contract auditing

Auditing helps achieve a variety of goals, including:

Finding and fixing vulnerabilities

Auditors check smart contracts for various downfalls. Some are found immediately, but most can only be identified with the use of special techniques and tools. For example, during market manipulation, a vulnerable smart contract may be attacked with flash loans. To find such bottlenecks, auditors try to hack a smart contract. Here are the most common types of attacks they imitate:

- Recursive call. A contracts another, external contract, before committing changes. After that, the second contract can recursively interact with the first one in an invalid way, since the balance of the first one hasn’t been updated yet.

- Front running. When the execution of a contract depends on its position in a block, one can push a transaction forward in the queue by overpaying for gas and thus unfairly win auctions, lotteries, and games.

- Integer overflow. When a contract performs an arithmetic operation, the value may exceed the storage capacity, resulting in an incorrect calculation of amounts.

Addressing security errors

Auditors also examine the network that hosts the smart contracts and the application programming interface (API) used to interact with dApps. If it turns out that the project can’t withstand a DDoS attack or its API is compromised, it will be unsafe for users to connect crypto wallets to potentially harmful blockchain apps.

Optimizing gas expenses

On top of analysing blockchain security, auditors look at how optimized and efficient smart contracts are. Seasoned blockchain developers try to optimize their performance. But inexperienced enthusiasts may neglect optimization.

Some smart contracts need to send a series of transactions to be executed. Given that gas fees are high on networks like Ethereum, efficient smart contracts could help save on transaction fees. And if they are inefficient, expensive gas could disrupt their operation.

How smart contracts are audited

A security audit is a common service. And though different audit firms may employ different approaches, here is a typical plan most of them follow:

- Determining the scope of work. Contract specifications depend on the project’s purpose and architecture. They help auditors find out which goals developers pursued when writing the smart contract.

- Estimating the audit cost based on the scope of work.

- Carrying out the audit. The techniques and tools used vary from company to company. Both automated and manual examination methods can be used.

- Drafting a bottleneck report. It’s then submitted to the team for troubleshooting.

- Drawing up a final report describing action taken by developers to fix the problems found.

What an audit report is

A report is submitted at the end of the audit. In most reports, problems are categorised by severity: critical, major, minor, trivial. The problem status is also indicated, and is updated in the final report if the team had managed to fix the related error before the final report was drawn up.

Besides general takeaways, the report contains recommendations, code error review, and examples of inefficient code. When the project team receives the final report, they can publish the full version or the key findings in the community.

How much it costs to audit a smart contract

The audit cost depends on the number of smart contracts to be reviewed. On average, an audit costs 2000–3000 USD. In a more complex case, it can cost over 10,000 USD. Another factor affecting the cost of service is the reputation of the audit firm.

]]>Netside is respected in the market. But we don’t think our reputation should be reflected in our rates. Send us a request to find out how much an audit will cost you.

The development and use of decentralized finance leads to destruction of the traditional model of the financial system, which has always had shortcomings. In the new model, financial processes will work more efficiently thanks to smart contracts. In transparent transactions that are verified and executed independently, there will be no room for intermediaries and fraudsters. The next step in the financial technology revolution that began in 2008 with the advent of blockchain technology has arrived.

What DeFi is

Decentralized finance started to attract attention after all markets crashed in March 2020, but few people understand its essence so far. At first, the term was used to refer to analogues of traditional financial instruments that are implemented in a decentralized architecture. Now they have grown into a widely accessible ecosystem consisting of decentralized applications (dApps) and services powered by public blockchains.

The goal of decentralized finance is to create a financial system that would be open to everyone and wouldn’t require user trust, as well as to promote the self-sustainability principle. Conservatives consider this principle a disadvantage, but it encourages people to take responsibility for their investments.

The difference between DeFi and FinTech

Decentralized finance seems similar to financial technology (FinTech) that is also aimed at modernising financial services. However, the difference is that while FinTech relies on a conventional financial infrastructure, DeFi offers completely new components.

Let’s recall, for example, TransferWise, a fintech service for international payments. Though its fees are several times lower than those of most banks, it still uses bank accounts and other infrastructure elements that may have become obsolete. With bank accounts in many countries, TransferWise makes it easy for customers to transfer money. When you send euros to someone living in another country, such fintech services capture your money, and to the recipient, they give the funds from the corporate account in the recipient’s country. This speeds up transaction processing and reduces fees.

Now let’s compare the above model with DeFi services, for example, Dai transfers. Instead of centralized intermediaries such as banks or fintech companies, Ethereum stakers verify Dai transactions. They will process your transaction for an amount equalling one US dollar, and this will only take 15 seconds — the period required to create one block in which verified transactions are recorded. As a cherry on top, you can send your Dais to anyone who has a wallet that supports ERC-20 tokens. Your recipient can receive them in 15 seconds, even in a country under sanctions or with an outdated financial system.

Where DeFi is used

Decentralized finance is an accessible alternative to most traditional financial services, allowing anyone who has an internet connection and some awareness of cryptocurrencies to interact with the DeFi ecosystem. For that, developers have created a hundred new blockchain projects with their own protocols, distributed networks, decentralized services, and dApps.

When we take on DeFi, we start with the terms of reference for the project development. Without detailed ToR, we won’t be able to evaluate and start creating your future DeFi project.

Stablecoins

Decentralized finance first started to be used in stablecoin projects. This is a cryptocurrency, the price of which is pegged to the price of a reference financial instrument (usually fiat currency or commodity). Thus, all the issued stablecoin units are backed by a reserve stored at a reliable custodian. The value of the USD-pegged stablecoins is ensured by the issuer, while their purchase and sale are subject to AML/KYC procedures.

Examples of DeFi projects with stablecoins: Liquity USD (LUSD), USDD, Wrapped Bitcoin (WBTC). The latter is pegged to the price of bitcoin, but is powered by the Ethereum blockchain.

Decentralized autonomous organizations